Subtotal $0.00

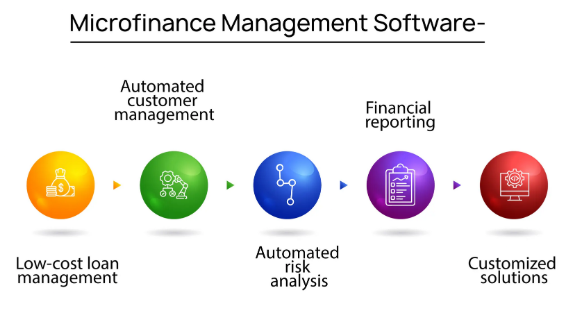

Microfinance institutions (MFIs) play a vital role in empowering underserved populations by providing access to credit, savings, insurance, and other financial services. As the microfinance sector grows increasingly complex, efficient management becomes crucial. This is where microfinance management software steps in, offering robust solutions to streamline operations, enhance productivity, and improve service delivery.

Choosing the right microfinance software is pivotal for MFIs to maintain accuracy, compliance, and customer satisfaction. But what exactly should a microfinance management software offer? This article dives deep into the key features every microfinance management software should have, exploring how these functionalities enable MFIs to operate smoothly and scale sustainably.

1. Introduction to Microfinance Management Software

Microfinance institutions (MFIs) provide critical financial services to underserved communities, enabling individuals and small groups to access loans, savings, and insurance products that traditional banks may not offer. Managing these services efficiently is vital for the sustainability and success of MFIs. This is where microfinance management software plays a crucial role.

Microfinance management software is a comprehensive digital solution designed to automate the wide array of operations MFIs handle daily. From managing loan applications and disbursements to tracking repayments and savings accounts, the software helps streamline processes, improve accuracy, and provide better customer service.

Unlike generic financial software, microfinance solutions are tailored to address the specific needs of MFIs. They accommodate unique lending models such as group lending, microloans with flexible repayment schedules, and interest calculation methods suited to low-income clients. They also help institutions comply with various regulatory requirements, manage risks, and generate meaningful reports.

Choosing the right microfinance management software can transform how an MFI operates. It reduces manual errors, speeds up workflows, and provides real-time insights into the financial health of the institution. Ultimately, this empowers MFIs to reach more clients, offer better services, and operate more sustainably.

This article explores the key features that every microfinance management software should have. Understanding these features will help MFIs select the right solution that fits their operational complexity, compliance needs, and growth ambitions.

2. Why Microfinance Software is Essential for MFIs

Microfinance institutions face multiple challenges, including managing large client databases, complying with stringent regulatory requirements, and handling complex financial transactions. Operating manually or with fragmented tools can slow down processes, introduce errors, and limit the institution’s ability to scale. This is why microfinance management software has become essential.

First, software automates repetitive tasks such as loan disbursements, repayment tracking, and interest calculations. Automation frees staff from tedious manual work, allowing them to focus on client relationships and strategy. It also reduces human error, which is critical when dealing with financial data.

Second, microfinance software enhances transparency and accountability. With digital records and audit trails, every transaction and client interaction is logged. This traceability is vital for internal audits and regulatory compliance, ensuring that the institution meets all legal and reporting requirements.

Third, the software provides better client management. MFIs often serve clients in remote locations or rural areas, making data management challenging. A digital platform helps track client profiles, loan history, and savings activity efficiently. This leads to faster loan approvals and improved customer service.

Moreover, real-time reporting and analytics allow management to monitor key performance indicators, spot trends, and make informed decisions. This proactive approach helps reduce loan defaults, optimize portfolios, and plan for growth.

Lastly, microfinance management software facilitates digital integration with payment gateways and mobile platforms. This enables clients to make repayments or deposits conveniently via mobile money or online banking, expanding the institution’s reach.

In summary, microfinance software is not just a convenience; it’s a strategic tool that strengthens operational efficiency, compliance, and client engagement, ensuring MFIs thrive in a competitive financial landscape.

3. Core Features of Microfinance Management Software

Loan Management

At the heart of any microfinance institution is loan management. Effective microfinance management software must support all stages of the loan lifecycle — from application and approval to disbursement and repayment tracking. It should handle various loan types, including individual and group loans, with flexible terms to accommodate the unique needs of microfinance clients.

Key functions include automated interest calculation using different models (flat rate, declining balance), dynamic repayment schedules, and penalties for overdue payments. The software should also facilitate loan restructuring and rescheduling in case of client hardship. Features like automated reminders for repayments and delinquency tracking help improve collection rates and reduce non-performing loans.

Client Management

Microfinance institutions serve diverse clients, often dispersed over wide geographic areas. Robust client management features are essential. The software should allow for creating detailed client profiles, including personal information, contact details, loan and savings history, and KYC documents.

Group lending is a common model in microfinance; hence, the system should support group account management and collective liability tracking. Client segmentation and categorization capabilities help tailor products and marketing strategies to different client groups, improving service relevance and satisfaction.

Savings and Deposit Management

Besides lending, many MFIs offer savings products to encourage financial inclusion. The software should support multiple savings schemes, such as recurring deposits, fixed deposits, and voluntary savings. It must accurately calculate interest on savings, track deposits and withdrawals, and provide real-time balance updates.

Effective savings management also helps MFIs generate additional revenue and foster client loyalty by promoting a culture of saving, which in turn reduces dependence on external funding.

Accounting and Financial Management

Integration of accounting functions within microfinance management software is crucial for maintaining financial integrity. Features should include a general ledger, accounts payable and receivable, cash flow management, and financial reconciliation.

Accurate accounting ensures MFIs can produce timely financial statements, manage budgets, and plan resources effectively. It also supports audit preparation and compliance with statutory financial regulations.

Reporting and Analytics

Data-driven decision-making is a cornerstone of modern microfinance. The software should provide a wide range of reports, including loan portfolio performance, repayment schedules, savings trends, delinquency rates, and financial summaries.

Customizable dashboards and real-time analytics allow management to track institutional health and make proactive adjustments. Regulatory reports, tax filings, and audit reports should also be easily generated to ensure compliance.

Compliance and Regulatory Management

Microfinance operates under strict regulations to protect clients and ensure financial stability. The software must automate regulatory reporting, maintain detailed audit trails, and support KYC and AML processes.

Compliance features reduce the risk of fines and penalties and help maintain the institution’s credibility with regulators and donors.

Mobile Accessibility and Digital Integration

With increasing digital adoption, mobile access is vital. The software should offer mobile apps or responsive web portals enabling field officers and clients to interact with the system remotely.

Integration with digital payment gateways and mobile money platforms ensures seamless transactions, enhancing client convenience and operational efficiency.

Security and Data Protection

Handling sensitive client and financial data demands robust security measures. Features like role-based access control, encryption, two-factor authentication, and regular data backups safeguard information from unauthorized access and data loss.

Compliance with data protection laws ensures client trust and institutional reputation.

4. Advanced Features to Look For

Automated Workflow and Task Management

Automation beyond basic functions can revolutionize microfinance operations. Advanced microfinance management software should enable configurable workflows that route loan applications, approvals, and other tasks automatically to the relevant staff. Notifications and reminders help ensure timely action and reduce bottlenecks.

Digital document management simplifies storing, retrieving, and updating client and transaction documents, increasing operational efficiency.

Risk Management and Credit Scoring

Risk mitigation is crucial to the financial health of MFIs. Software with built-in credit scoring models uses client data and historical behavior to assess loan repayment likelihood. Risk dashboards offer insights into portfolio health, delinquency trends, and high-risk segments.

Predictive analytics tools can forecast defaults before they occur, allowing proactive intervention. Management of collateral and guarantees should also be integrated.

Multi-Currency and Multi-Branch Support

MFIs expanding across borders or regions need software that supports multiple currencies with real-time exchange rate updates. Multi-branch capabilities allow institutions to consolidate data and manage policies across locations while granting branch-level autonomy.

Centralized control ensures consistency, simplifies reporting, and enhances governance.

Integration with Payment Gateways

The software should seamlessly connect with banks, mobile wallets, and payment aggregators to facilitate loan disbursements and repayments. Real-time transaction updates reduce reconciliation efforts and improve cash flow visibility.

Support for bulk payments enables efficient salary disbursements or mass collections.

Customer Communication and Engagement Tools

Maintaining transparent communication with clients improves loyalty and reduces misunderstandings. Features such as automated SMS and email notifications for repayments, approvals, and policy updates keep clients informed.

Client portals enable self-service, where customers can track loans, download statements, or submit queries. Feedback and complaint management modules help institutions improve services.

Cloud-Based Architecture

Cloud-based microfinance software offers flexibility, scalability, and cost efficiency. Institutions can access the system anytime from anywhere without investing in costly infrastructure.

Automatic software updates, backups, and disaster recovery enhance reliability. Cloud solutions also support rapid scaling as institutions grow or enter new markets.

5. User Experience and Customization

User-Friendly Interface

A crucial aspect often overlooked when selecting microfinance management software is the user experience (UX). The software should offer an intuitive and easy-to-navigate interface for all users, including loan officers, accountants, branch managers, and clients. A cluttered or complex interface can slow down operations and increase training time, especially for field staff who may not be highly tech-savvy.

Features like clear dashboards, well-organized menus, and logical workflows make day-to-day tasks simpler and more efficient. The ability to access essential functions quickly boosts staff productivity and reduces errors.

Customization to Fit Unique Needs

No two MFIs are exactly alike. Therefore, the ability to customize the software to meet the specific workflows, loan products, and policies of an institution is paramount. Customization options may include adding new fields, modifying loan approval processes, or adjusting interest calculation methods.

Software that supports configurable workflows allows MFIs to adapt to changing regulatory environments and client needs without waiting for vendor upgrades. It also enables institutions to differentiate their products and maintain competitive advantages.

Multilingual and Role-Based Access

Many MFIs serve clients across different regions with diverse languages. Supporting multiple languages in the user interface and client communications improves accessibility and client satisfaction.

Role-based access controls ensure that users only see data and functions relevant to their roles. For example, loan officers may have access to client and loan data, while accountants handle financial records. This approach enhances security while streamlining user experience.

Mobile and Offline Capabilities

In rural or low-connectivity areas, having software that works offline on mobile devices and syncs automatically when online is a game-changer. This ensures uninterrupted operations even in remote locations.

6. Benefits of a Robust Microfinance Management Software

Operational Efficiency and Cost Savings

A well-designed microfinance management software automates routine tasks like loan disbursement, repayment scheduling, and accounting. Automation reduces manual errors and speeds up processing times, freeing staff to focus on client engagement and growth strategies. This translates to significant cost savings on labor and administrative overhead.

Enhanced Client Experience

With real-time updates, mobile access, and digital payment options, clients can interact more easily with their accounts. Faster loan approvals and transparent communication build trust and encourage repeat business. Client portals allow customers to check balances, track repayments, and even apply for new loans without visiting branches.

Accurate Financial Management and Compliance

Integrated accounting modules ensure accurate record-keeping, simplifying audits and regulatory reporting. Automated compliance features help MFIs stay ahead of changing rules, reducing the risk of penalties or operational disruptions.

Risk Mitigation and Portfolio Health

Advanced analytics and credit scoring enable proactive risk management. By identifying risky loans early, MFIs can take corrective action to minimize defaults and maintain portfolio quality.

Scalability and Growth

As MFIs grow, they need systems that can handle increasing client bases, multiple branches, and more complex financial products. Robust microfinance software provides scalable infrastructure that grows with the institution, supporting expansion without compromising performance.

7. How to Choose the Right Microfinance Management Software

Assess Institutional Needs

Before selecting software, MFIs should thoroughly analyze their operational requirements, loan products, client base size, and regulatory environment. Understanding current pain points and future goals helps narrow down suitable options.

Evaluate Features and Functionality

Review the core and advanced features offered by software vendors. Ensure essential functions like loan management, savings accounts, accounting, reporting, and compliance are robust. Check for mobile access, integration capabilities, and customization options.

Consider Vendor Reputation and Support

Research vendor track records, client testimonials, and market presence. Reliable customer support, training, and ongoing maintenance services are crucial for smooth implementation and continued success.

Trial and Pilot Testing

Request demos or trial versions to assess software usability and compatibility with existing systems. Pilot testing with a subset of clients or branches helps identify potential issues before full-scale rollout.

Cost-Benefit Analysis

Compare pricing models against the value delivered. Consider not just upfront costs but also ongoing fees, customization charges, and savings from efficiency gains.

Security and Compliance Assurance

Ensure the software complies with relevant data protection laws and includes strong security features to safeguard sensitive client information.

8. Future Trends in Microfinance Software

Artificial Intelligence and Machine Learning

AI-powered credit scoring and risk assessment are transforming microfinance. Machine learning models analyze vast data sets to predict repayment behavior more accurately, enabling smarter lending decisions and personalized products.

Blockchain for Transparency and Security

Blockchain technology promises immutable transaction records and decentralized verification, enhancing transparency and reducing fraud risks in microfinance operations.

Fintech Integration and Open APIs

Greater integration with fintech platforms allows MFIs to offer seamless digital wallets, mobile payments, and value-added financial services, expanding their reach and improving client convenience.

Biometric Identification

Biometric technologies like fingerprint and facial recognition are becoming popular for secure and quick client authentication, especially in remote areas where traditional IDs may be lacking.

Enhanced Mobile-First Solutions

With mobile penetration rising globally, microfinance software will increasingly prioritize mobile-first design, enabling clients and field officers to access services anytime, anywhere.

Personalized Financial Products

Data analytics enable MFIs to tailor products to individual client needs, increasing engagement and financial inclusion.

9. Conclusion

Summarizing the Importance of Key Features

In today’s fast-evolving microfinance landscape, selecting the right microfinance management software is a strategic decision that can define the success and sustainability of an institution. This software is not just a digital tool but a comprehensive platform that integrates loan processing, client management, accounting, compliance, and reporting — all essential to streamline complex operations.

Having core features such as efficient loan management, robust client data handling, savings management, real-time financial reporting, and strong regulatory compliance safeguards MFIs against operational inefficiencies and risks. Equally important are advanced capabilities like automated workflows, credit scoring, multi-branch support, and seamless digital payment integration, which help institutions stay competitive and agile.

Driving Growth and Financial Inclusion

A well-chosen microfinance management software empowers institutions to serve clients better by reducing turnaround times, improving transparency, and offering convenient digital access. This, in turn, fosters greater financial inclusion by reaching underserved populations more effectively.

Security and data protection features protect sensitive client information, build trust, and ensure compliance with laws — factors crucial in maintaining reputation and longevity.

Embracing Future Trends

As microfinance continues to evolve, software solutions must keep pace with emerging technologies like AI, blockchain, and biometric authentication. Institutions adopting these innovations will gain deeper insights, better risk management, and enhanced customer experiences.

Final Thoughts

Every microfinance institution should carefully evaluate their unique operational needs, consider the essential and advanced features discussed, and select a software platform that not only addresses today’s challenges but also supports future growth and innovation. Doing so will position them to maximize their social impact while maintaining financial sustainability in an increasingly digital world.